Demonetisation and Supreme Court’s verdict

2023 JAN 11

Mains >

Economic Development > Indian Economy and issues > Major Judgements

IN NEWS:

- A Constitution Bench of the Supreme Court upheld by a 4:1 majority the decision taken by the central government in 2016 to demonetise currency notes of Rs 500 and Rs 1,000 denominations.

BACKGROUND:

- Demonetization is the act of stripping a currency unit of its status as legal tender.

- On 8th November 2016, the Government of India announced the demonetisation of all Rs. 500 and Rs. 1,000 banknotes of the Mahatma Gandhi Series.

- It also announced the issuance of new Rs. 500 and Rs. 2,000 banknotes in exchange for the demonetised banknotes.

- Government claimed that the action would curtail the shadow economy, increase cashless transactions and reduce the use of illicit and counterfeit cash to fund illegal activity and terrorism.

WHAT DID THE COURT SAY?

|

Section 26(2) of RBI Act:

- The main point of difference between the majority and minority judgments was the interpretation of Section 26(2) of the RBI Act, 1934.

- Section 26(2) says, “On recommendation of the Central Board the Central Government may, by notification in the Gazette of India, declare that, with effect from such date as may be specified in the notification, any series of bank notes of any denomination shall cease to be legal tender save at such office or agency of the Bank and to such extent as may be specified in the notification.”

- The notification issued by the central government on 8 November 2016, demonetising the notes, was issued under Section 26(2) of the Act.

- The bench was considering whether the power available to the central government under Section 26(2) means that it can be exercised only for “one” or “some” series of bank notes and not “all” series of bank notes.

- The court was also facing questions on the legality of the decision making process while issuing the demonetisation notification.

|

- The majority judges held that the Centre’s notification was valid and satisfied the test of proportionality.

- The majority viewed that the statutory procedure under Section 26(2) of the RBI Act was not violated merely because the Centre had taken the initiative to “advise” the Central Board of the RBI to consider recommending demonetisation. The government was empowered under the provision to demonetise “all series” of banknotes.

- The majority also noted that the RBI and the central government were in consultation with each other for a period of six months before the notification was issued and hence accepted the claim that there was adequate consultation between them.

- The majority decision applied the test of proportionality to the constitutionality of the decision.

|

Ingredients of proportionality test

|

Supreme Court’s view

|

- Legitimate purpose

|

Curbing fake currency, black money and terror funding are legitimate interests of the state and have a rational nexus with demonetisation.

|

- Rational connection with the purpose

|

- Necessity

|

No alternate measures could have been taken to achieve the intended purpose of demonetisation.

|

- Whether the action taken is proportional or balanced

|

“What alternate measure could have been undertaken with a lesser degree of limitation is very difficult to define”.

|

- On the question whether the objectives of demonetization were achieved or not, the Court said that it did not have the expertise to go into the question.

- On the hardships faced by the people, the Court said that merely because some citizens have suffered hardships, that would not be a ground to hold the decision bad in law.

- However, the dissenting judge held that though demonetisation was well-intentioned and well thought of, it has to be declared unlawful on legal grounds (and not on the basis of objects).

- The judge viewed that since the proposal was not initiated by the RBI, the demonetisation exercise could have been undertaken by the central government only through an ordinance or a parliamentary law.

- The judge also ruled that when the RBI recommends demonetisation, it is only for a particular series of bank notes of a particular denomination.

|

What is the test of proportionality?

- The test of proportionality is a commonly employed legal method used by courts around the world, typically constitutional courts, to decide cases where two or more legitimate rights clash.

- When such cases are decided, one right typically prevails at the expense of the other and the court thus has to balance the satisfaction of some rights and the damage to other rights resulting from a judgement.

How is it determined?

- To determine whether something can be said to pass the test of proportionality, courts in India typically take a four-pronged approach wherein the legitimacy, suitability, and necessity of a decision or law is examined, in addition to a balancing test to check whether said decision or law encroaches on rights to an excessive or abitrary degree.

|

SUCCESSES OF DEMONETISATION:

- Fall in illicit activities:

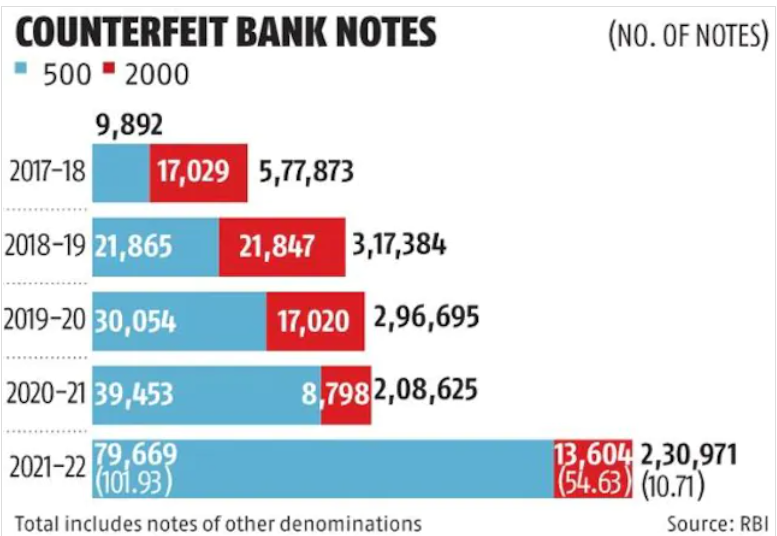

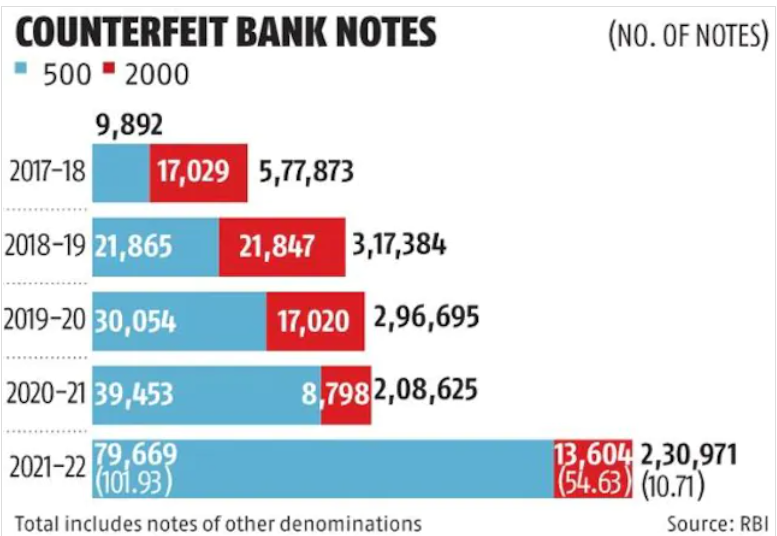

- The total number of counterfeit notes detected decreased post demonetisation, especially Pak-printed high quality fake Indian currency notes.

- It also reduced money laundering activities through shell companies and hawala operators. Eg: Indian regulatory agencies tracked down about Rs 17,000 crore of suspicious transactions by shell companies after analysing data following the demonetisation.

- The cash crunch caused by the demonetization forced the Naxalites and other insurgent groups to reduce their operations and attacks. It also increased the surrenders and arrests in the last few years.

- Combat black money:

- Post demonetisation monitoring has enabled the Income Tax Department to detect 18 lakh people with disproportionate income and about Rs 1.75 lakh crore of suspicious deposits. Subsequent action and exaction of tax with penalties were initiated against them.

- Improved tax compliance:

- According to IT Department data, number of income tax returns filed surged 14.5 per cent in FY 2016 and then jumped 20.5 per cent in FY 2017, the year of demonetisation. In the subsequent year FY 2018, income tax returns filed surged further 23.1 per cent to 68.7 million.

- Major push for digital economy:

- Demonetisation encouraged adoption of digital payment instruments such as wallets and Unified Payments Interface (UPI), and also opened the doors for several start-ups such as Paytm.

- As per SBI studies, the digital transactions’ share is continuously increasing from 11.26% in 2015-16 to 80.4% in 2021-22 and is expected to touch 88% in 2026-27.

- Increased the pace of formalisation:

- Demonetisation led to increased use of formal banking facilities, adoption of digital payments, more IT return filings and strong GST collections, all of which contributed to further formalisation of India’s economy.

CRITICISM OF DEMONETISATION:

- Distress for people:

- The sudden withdrawal of notes resulted in liquidity shortage in 2016, with long queues outside banks. About 115 people reportedly died while standing in queues to withdraw money from their bank accounts.

- Questionable success in tackling black money:

- The RBI has indicated that 99.3% of the demonetised currency or roughly Rs 15.31 lakh crore was returned and only Rs 10,720 crore did not reach to the banks or the RBI. This contradicts the government’s statement that approximately Rs 3 lakh crore of unaccounted wealth reached the banks following demonetisation.

- Economic impact:

- There was an economic output loss of nearly Rs 2 lakh crore and decline in GDP growth by 1.5 per cent in the year post-demonetisation.

- According to the Centre for Monitoring Indian Economy (CMIE), demonetisation caused loss of about 15 lakh jobs.

- Increased proportion of high-value notes:

- Before demonetisation, Rs 500 and Rs 1,000 notes accounted for 86% of the currency in circulation. In the Supreme Court, the government had stated the massive increase in the circulation of the notes as a reason behind demonetisation.

- However, today the proportion of high-value notes is only marginally lower. Eg: On March 31, 2022, Rs 500 denomination banknotes accounted for 73.3 percent of notes in circulation.

- Stagnant tax to GDP ratio:

- Despite demonetisation, India’s overall taxes to GDP is at 17 per cent. That is, the taxed portion of India’s economic activity remains the same, before and after demonetisation.

- Cash based economy:

- Cash continues to dominate the market as the preferred mode of payment. Cash in circulation has increased from Rs 17.2 lakh crore in 2016 to Rs 32 lakh crore in 2022. This increases chances of tax evasion, counterfeiting etc.

- Increase in fake notes:

- Question of accountability:

- In the past (1946 and 1978), high-denomination notes were demonetized through an Ordinance that was replaced by an Act of Parliament. Hence, the responsibility for the outcomes, good or bad, lay with the parliamentarians.

- However, the 2016 demonetisation was through an executive notification. So, the people’s representatives cannot be blamed for the failure of the objectives or for the economic consequences.

CONCLUSION:

- Several documents, on the basis of which the majority supported the government, were secret documents. For ensuring transparency and reassuring public’s trust, government must disclose those documents which does not undermine the national security to the public.

- Following the well settled principle that there must be judicial deterrents in matters of economic policy, the court has settled the legal argument over demonetisation. However, on the political and economic argument, the debate is not over and Parliament must engage in it.

PRACTICE QUESTION:

Q. ‘If seen from a larger perspective of economic and social benefits, it cannot be said that demonetisation failed’. Analyse.

For Mains, questions on demonetisation may be asked in GS 3 (Economic development). The content can also be used in questions related to internal security, formalisation of Indian economy and digitisation.

For Prelims, questions on demonetisation and its impact on economy can be asked.