Fiscal Deficit

2020 DEC 17

Mains >

Economic Development > Indian Economy and issues > Fiscal deficit

IN NEWS:

- The government’s fiscal deficit has widened further to Rs 9.53 lakh crore, which is nearly 120 per cent of the annual budget estimate, at the end of October of the current financial year.

FISCAL DEFICIT:

- The government describes fiscal deficit as “the excess of total disbursements from the Consolidated Fund of India, excluding repayment of the debt, over total receipts into the Fund (excluding the debt receipts) during a financial year”.

|

Fiscal Deficit = Total expenditure of the government (capital and revenue expenditure) – Total income of the government (Revenue receipts + recovery of loans + other receipts)

|

|

Income of the government

|

|

Revenue receipts

|

Capital receipts

|

|

Tax revenues:

Non-tax revenues:

- Interest Receipts

- Dividends and Profits

- External Grants

- Receipts of union territories

Other non-tax revenues:

- Returns from fiscal, social and economic services

|

Debt:

- Borrowings-Internal and external

- Other liabilities like small savings, provident fund

Non debt:

- Loan recoveries

- Disinvestments

|

|

Expenditure of the government

|

- Revenue Expenditure

- Capital Expenditure

- Interest Payments

- Grants-in-aid for creation of capital assets

|

- The fiscal deficit is usually mentioned as a percentage of GDP. For eg: if the gap between expenditure and total income is Rs 5 lakh crore and the country’s GDP is Rs 200 lakh crore, the fiscal deficit is 2.5% of the GDP.

- The government meets fiscal deficit by borrowing money. So, in a way, the total borrowing requirements of the government in a financial year is equal to the fiscal deficit in that year.

WHAT CAUSES FISCAL DEFICIT IN INDIA:

- Fall in Income:

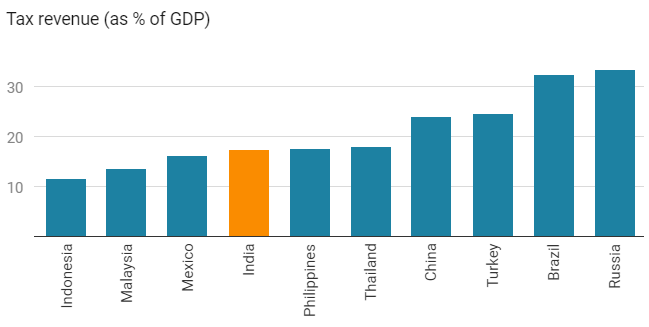

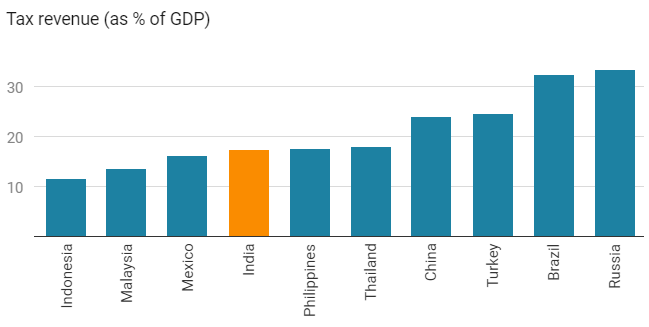

- The net tax collection to GDP has been on the lower side for long. Also, indirect tax collection has suffered recently because of persistent issues with the implementation of GST.

-

- Also, under the present circumstances in which nearly 65% of the economic sectors were shut during the pandemic, tax revenues further declined.

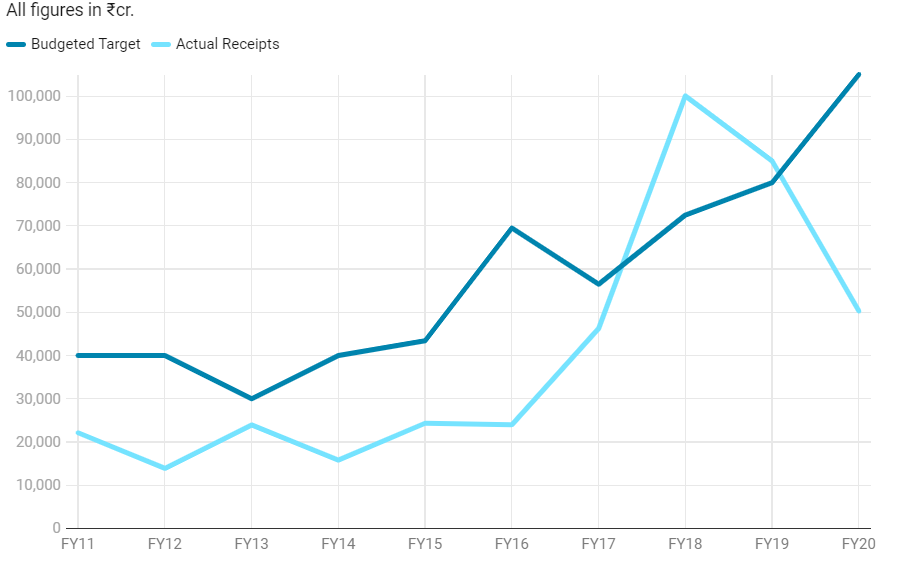

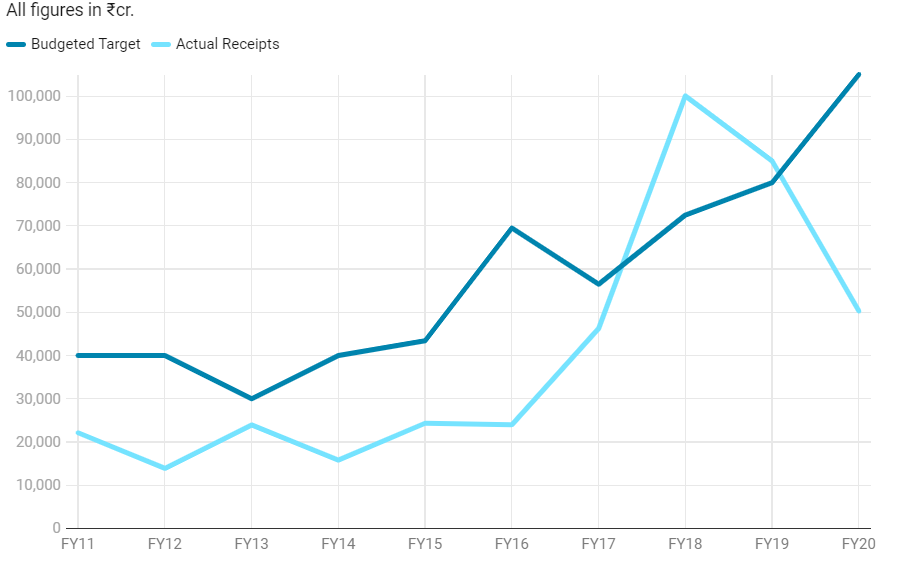

- Government has also missed its disinvestment targets in recent years.

- Rise in Expenditure:

- High Inflation: Despite being under control, inflation in India has been on high, making imports and borrowings costlier.

- High social expenditure: Investment in social infrastructure is a pre-requisite for inclusive growth and employment in a developing country like India.

- External factors: Since India depends on import of several essential commodities like crude oil, external market volatilities increase Indian expenditure.

- Unproductive expenditures: Government has to spend on several unproductive areas like subsidies and defence.

- Rise in Borrowings:

- For implementing policies like bank recapitalization, farm loan waivers and UDAY, central and state governments are borrowing from the market.

IMPACT OF HIGH FISCAL DEFICIT:

There is no set universal level of fiscal deficit that is considered good. A high fiscal deficit can be good for the economy if the money spent goes into the creation of productive assets like highways, roads, ports and airports that boost economic growth and result in job creation. However, it can also have detrimental impacts like:

- Debt Trap: Continued fiscal deficit creates a vicious circle, wherein government takes more loans to repay the earlier loans. As a result, country is caught in a debt trap.

- Inflation: As the governments borrow more to finance their fiscal deficits and accumulate more debt, interest rates tend to go up.

- Crowding out of private: When the government is borrowing from the market, lenders will be less interested in lending to the private. This leaves fewer avenues for the private to borrow and subsequently invest.

- Economic stagnation: Inflation and limited financing chokes off private investment as it raises cost for businesses. As a result, even when public spending increases, there is no net increase in employment and output in the economy.

- Degrade credit rating: a spike in government borrowing increases the danger of rating agencies downgrading India’s credit rating even further. This can affect external borrowing capabilities.

- Limits revenue spending: Due to the rising fiscal deficit, the central as well as some state governments have decided not to increase dearness allowance and dearness relief that they pay to their employees and pensioners.

- Foreign dependence: Government also borrows from rest of the world, which raises its dependence on other countries and exposes it to the fiscal policies of other governments.

TACKLING FISCAL DEFICIT:

- If the government continues to spend way more than its revenues, it will either have to print more currency or borrow from the market to meet the shortfall.

- Printing currency will fuel inflation and, at times, hyperinflation.

- Resorting to borrowings will crowd out the private sector and push up the interest rates, which will consequently slow down economic growth.

- In a bid to avoid these scenarios and mandate fiscal prudence, the Government of India passed the Fiscal Responsibility and Budget Management (FRBM) Act in 2003.

Fiscal Responsibility and Budget Management (FRBM) Act, 2003

- Its objective is to make the Central government responsible for ensuring inter-generational equity in fiscal management and long-term macro-economic stability.

- Initial targets:

- Limit the fiscal deficit to 3% of the GDP by March 31, 2009.

- Complete elimination of the revenue deficit.

- Reduction of liabilities to 50% of the estimated GDP by the year 2011

- Bar on the government from directly borrowing from RBI to monetize the deficit

- However, due to the global financial crisis (2007-08), the fiscal targets had to be postponed.

- Escape clause: Under Section 4(2) of the Act, the Centre can exceed the annual fiscal deficit target citing certain grounds, such as national security, calamity, collapse of agriculture and structural reforms.

- In May 2016, the government set up a committee under NK Singh to review the FRBM Act. The committee recommended that the government should target a fiscal deficit of 3 per cent of the GDP in years up to March 31, 2020, cut it to 2.8 per cent in 2020-21 and to 2.5 per cent by 2023.

- Current target: The latest provisions of the FRBM act requires the government to limit the fiscal deficit to 3% of the GDP by March 31, 2021, and the debt of the central government to 40% of the GDP by 2024-25, among others.

CONCLUSION:

- With the pandemic and the subsequent economic crisis, economic growth in the medium term may only be possible at the cost of a high fiscal deficit.

- To meet this crisis, India needs to adopt bold policy initiatives that allow high fiscal deficit to sustain growth. For this to happen, policy makers need to relook at the FRBM targets and postpone them if necessary.

- However, to take such decisions, a transparent and independent mechanism is essential. In this regard, the 14th Finance Commission recommended the establishment of an independent Fiscal Council under FRBM Act, with a mandate to promote stable and sustainable public finances.

- Also, the government can still rationalize its spending in other ways. For eg: The upcoming budget could be used to eliminate the revenue deficit entirely over a five-year period, by increasing tax intake and slashing recurring expenditure.

PRACTICE QUESTION:

Q. Financing the fiscal response to COVID-19 will increase the fiscal deficit of the country. In this regard, examine the need to review the FRBM targets?