National Monetisation Pipeline (NMP)

2021 AUG 30

Mains >

Industry and infrastructure > Industrial Policies > infrastructure

IN NEWS:

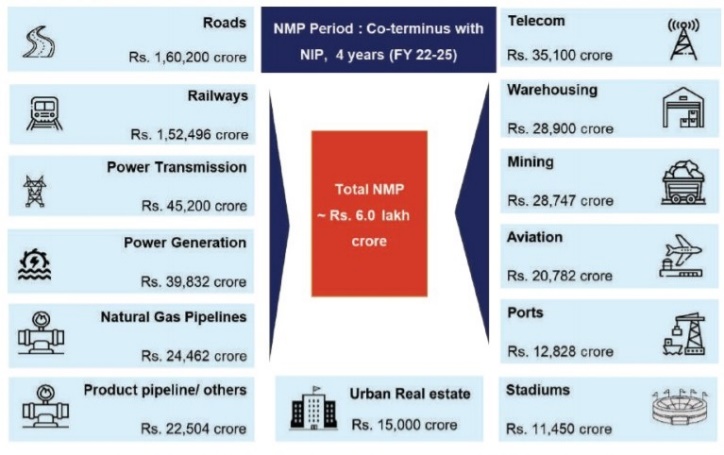

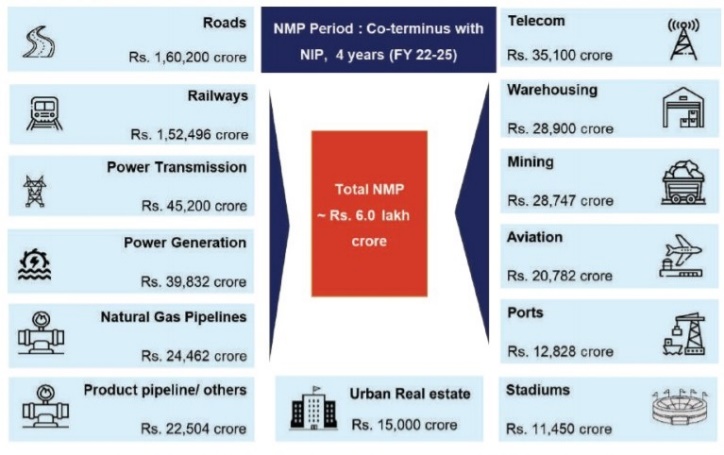

- Union government recently unveiled an ambitious four-year National Monetisation Pipeline (NMP) worth Rs 6 lakh crore to unlock value in brownfield projects.

NATIONAL MONETISATION PIPELINE:

- National Monetisation Pipeline (NMP) is an asset monetisation effort by the Government. It will serve as a medium-term roadmap for identifying potential monetisation-ready projects across various infrastructure sectors.

- The total indicative value of NMP for core assets is estimated at Rs 6 lakh crore over the four-year period FY22 to FY25.

- Key objectives of NMP are:

- Serve as a medium-term roadmap for the line ministries and agencies

- Provide medium-term visibility to investors on infrastructure assets pipeline

- Provide a platform for ministries to track asset performance

- Bring in greater efficiency and transparency in public assets management

- Other key features of the framework include:

- Monetisation of rights, not ownership >> the assets will have to be handed back at the end of transaction life.

- Monetisation of core brownfield (assets that are already operational) de-risked assets and not non-core assets such as real estate.

- Structured partnerships under defined contractual frameworks, with key performance indicators and performance standards.

- Monetisation will happen through Public-Private Partnerships (PPP) and Investment Trusts (NVTS).

- The government has identified 13 sectors for executing the NMP.

SIGNIFICANCE OF NMP:

- Asset recycling:

- By leasing out public assets to private investors, government can generate funds. These funds can be reinvested in new infrastructure, which can then be brough under asset monetisation.

- Equitable risk sharing:

- Transfer of rights in lieu of an upfront/periodic payment under a well-defined contractual framework enables a balanced risk sharing framework between the public authority and private party.

- Better service delivery:

- Private sector entities are expected to operate & maintain assets based on clear guidelines and performance indicators and generate returns through higher operating efficiencies. This would result in better service delivery and enhanced user experience.

- Mobilisation of resources:

- The NMP involves brownfield assets which are either languishing, not fully monetised or remaining underutilized. Asset Monetisation will help unlock the value of investments in public sector assets by tapping private sector capital and efficiencies.

- Enhance government resources:

- By creating a stable revenue stream, the pipeline can augment the financial resources of the government which are strained due to the unprecedented Covid crisis.

- Eg: The proceeds from the NMP are expected to account for about 14% of the total outlay for infrastructure under the National Infrastructure Pipeline.

- Improve investments:

- Investments in infrastructure is key for India to attain its target of USD 5 trillion economy. Asset monetisation will help attract the required quantum of capital into infrastructure sector.

- Maintain government ownership:

- The ownership of assets remains with the government and there will be a mandatory hand-back after a certain time. Thus, the government can retain ownership over its assets.

CHALLENGES:

- Increase in cost of service:

- There are concerns that leasing of airports, railways, roads and other public utilities to private investors could lead to higher prices for consumers.

- Cost of capital:

- Accessing debt capital is more expensive for a private player than a public entity. The higher cost of capital for the private player could offset the benefit of any reduction in operating costs and increase the cost of service delivered.

- Presumption of competitive bidding:

- It is expected that a competitive auction process will fetch the Government the right price while yielding efficiency gains. But that assumes that there will be a large number of bidders. However, previous experiences such as in Air India privatisation has proved this presumption to be incorrect.

- Challenges in value estimation:

- It is difficult to get the valuation right over a long-term horizon. Eg: For a highway, growth in traffic would depend on factors other than the growth of the economy, such as the level of economic activity in the area, the prices of fuel and vehicles, alternative modes of transport and their relative prices.

- Structural issues in economy:

- The NMP does not address the various structural problems such as legal uncertainty, delays in implementing labour codes and the absence of a deep bond market that hold back private investment in infrastructure.

- Concerns over PPP models:

- Due to disputes in existing contracts, non-availability of capital and regulatory hurdles, the private sector today lacks confidence in PPP models in India.

- Fear of crony capitalism:

- Opponents of the policy allege that the NMP will favor a few business corporations that are close to the government and give rise to corruption and crony capitalism.

- Potential for Monopoly:

- If there are only few takers for the projects, there is a high chance of concentration of economic power, like it is seen in case of telecom sector.

WAY FORWARD:

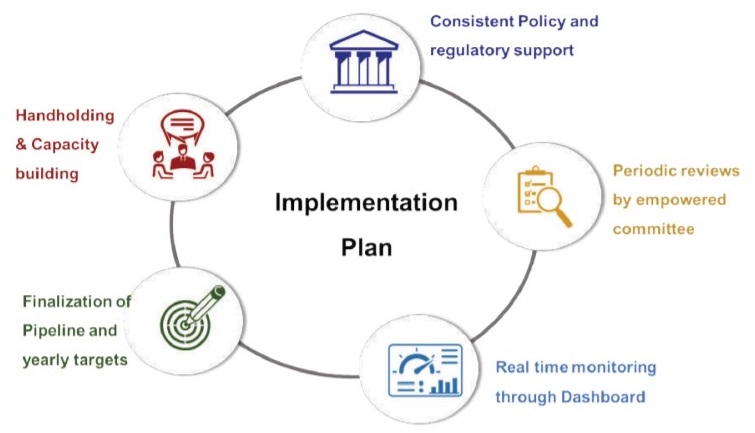

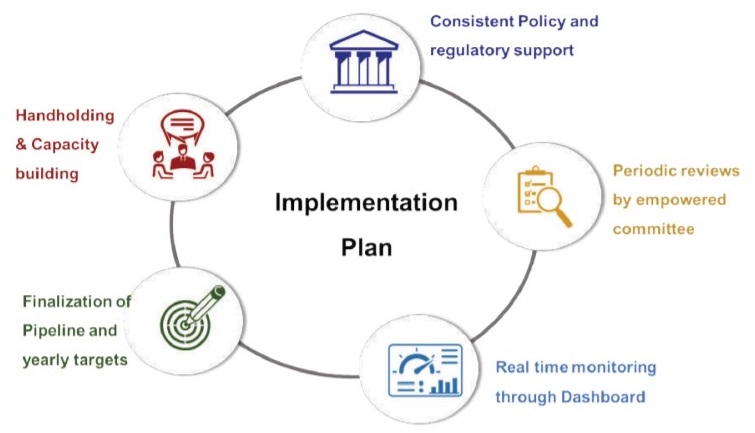

Monetisation needs to be viewed not just as a funding mechanism, but as an overall strategy for bringing about a paradigm shift in infrastructure augmentation, service delivery and maintenance. To ensure its success, the following measures can also be adopted:

- Create a Regulatory body:

- To ensure proper monitoring and execution, the Government may set up an independent Asset Monetisation Monitoring Authority staffed by competent professionals.

- Ensure transparency:

- To allay concerns of cronyism, the auctioning process needs to be fair and transparent, with a mechanism for ascertaining fair valuation of assets being auctioned off.

- Develop capital market:

- To facilitate the entry of new players, the capital market, particularly the secondary market needs to be enlarged.

- Capacity development:

PRACTICE QUESTION:

Q. Asset recycling is important to finance the infrastructure sector in India. In this regard, discuss the salient features of the National Monetisation Pipeline?