RBI's Digital Payment Index

2022 JAN 18

Preliminary >

Economic Development > Miscellaneous > Digital India

Why in news?

- Digital payment transactions reported a 40% year on year jump as of September 2021, as per the RBI’s latest ‘Digital Payment Index’ that measures the extent of digitization of payments.

About RBI's Digital Payment Index:

- Reserve Bank of India has constructed a composite Digital Payments Index (DPI) to capture the extent of digitisation of payments across the country.

- The RBI-DPI comprises of 5 broad parameters that enable measurement of deepening and penetration of digital payments in the country over different time periods.

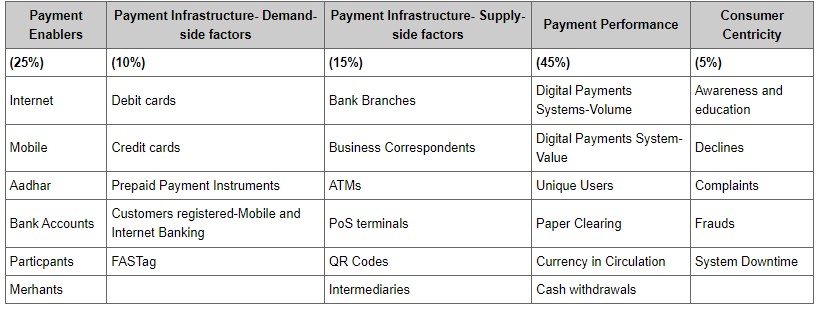

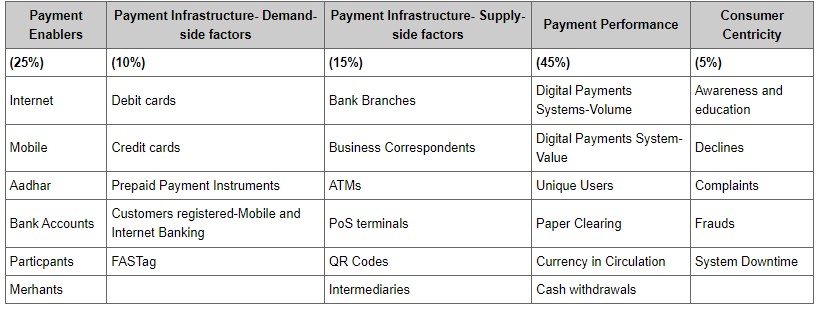

- These parameters are:

- (i) Payment Enablers (weight 25%)

- (ii) Payment Infrastructure – Demand-side factors (10%)

- (iii) Payment Infrastructure – Supply-side factors (15%)

- (iv) Payment Performance (45%)

- (v) Consumer Centricity (5%)

- Each of these parameters have sub-parameters which, in turn, consist of various measurable indicators.

- The RBI-DPI has been constructed with March 2018 as the base period, i.e. DPI score for March 2018 is set at 100.

- The Index is published on a semi-annual basis with a lag of 4 months.

- The value of index increased 2.7 times a span of 3 years, from 100 in March 2018 to 270.59 in March 2021.

PRACTICE QUESTION:

Digital payment index, that measures the extent of digitization of payments, is launched by

(a) NITI Aayog

(b) RBI

(c) National Payments Corporation of India

(d) SEBI

Answer