SOVEREIGN CREDIT RATING

2021 OCT 21

Mains >

Economic Development > Indian Economy and issues > Economic survey

IN NEWS:

- Ratings agency Moody’s recently changed India’s sovereign rating outlook from ‘negative’ to ‘stable’. The agency, however, maintained the country’s credit rating at ‘Baa3’ – the lowest investment grade.

SOVEREIGN CREDIT RATING:

- A sovereign credit rating is an independent evaluation of a country’s creditworthiness, or the extent to which it is suitable to receive credit.

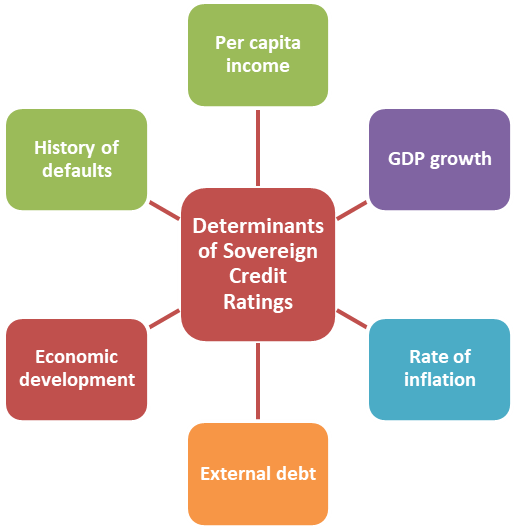

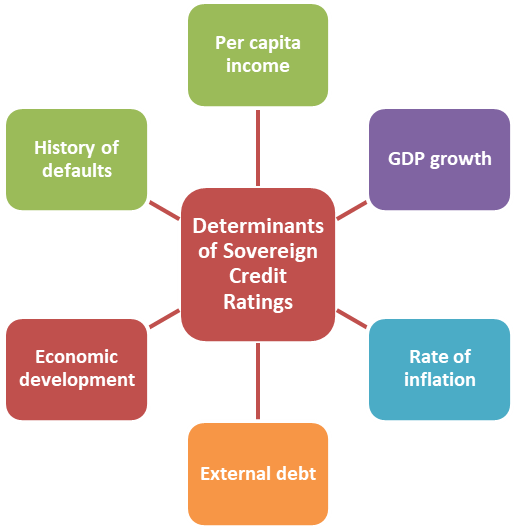

- When evaluating the creditworthiness of a country, credit rating agencies consider both qualitative and quantitative factors such as the political environment, debt service ratio, growth in domestic money supply, import ratio, and the variance of export revenue.

- Standard & Poor's, Moody's, and Fitch Ratings are the three most influential agencies. In India, there are six credit rating agencies registered under SEBI namely, CRISIL, ICRA, CARE, SMERA, Fitch India and Brickwork Ratings.

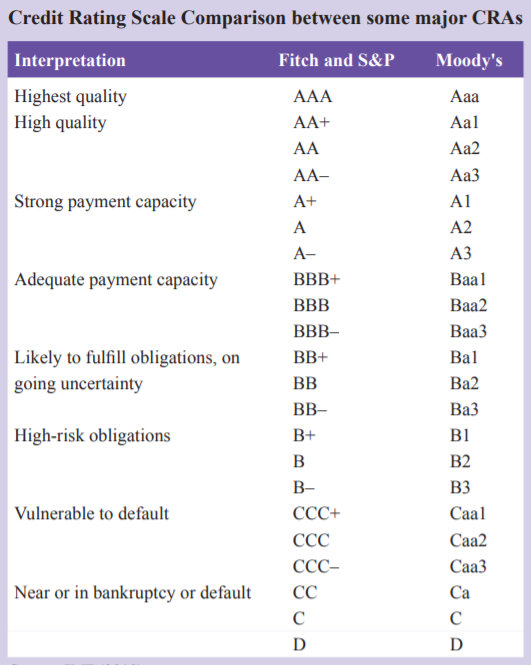

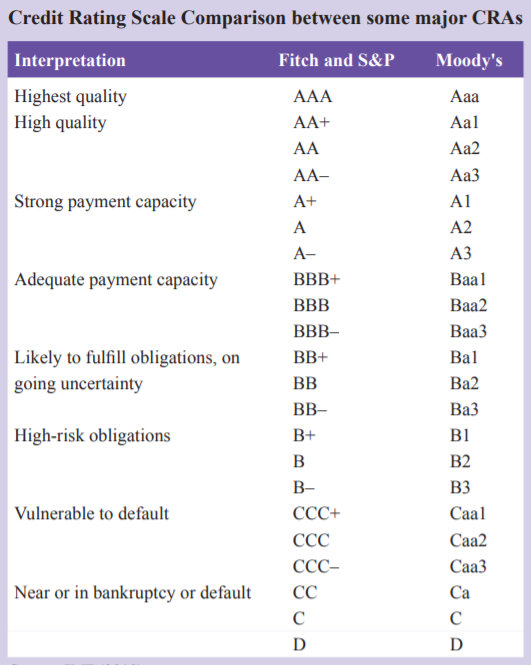

- A credit rating of AAA is the highest, while BBB- rating is the lowest among the investment grade bonds. Ratings below this fall within the ‘speculative’ or ‘junk’ grade.

WHY SOVEREIGN CREDIT RATING:

- Attract investment:

- Obtaining a good credit rating is important for a country that wants to access funding for development projects in the international bond market. Also, countries with a good credit rating can attract foreign direct investments.

- Assess risk:

- With the globalization and deepening of financial markets, it is impossible for lenders to have full information of all the borrowers in the world about their financial positions. Credit rating can give investors insights into the level of risk associated with investing in the country.

- Predict crisis:

- Credit rating agencies and their reports help countries to assess its economic situation and trajectory of growth. The agencies also help to detect potential cases of financial crisis and chances of defaulting on repayments.

- Express openness:

- By allowing external credit rating agencies to review its economy, a country shows that it is willing to make its financial information public to investors, which in turn enhances their trust in the country.

CRITICISM OF RATING AGENCIES:

- Bias and subjectivity:

- There is a large academic literature that highlights bias and subjectivity in sovereign credit ratings, especially against countries with lower ratings.

- Eg: Historically, the world’s fifth largest economy has been predominantly rated AAA. But India, despite the economic size and the ability to repay debt, has been rated as the lowest rung of the investment grade (BBB-/Baa3).

- Failure to predict:

- The efficacy of credit rating agencies in predicting sovereign defaults is debatable since they failed to predict the East Asian financial crises in the late 1990s and European debt crisis following the global financial crisis of 2008.

- Lack of accountability:

- The three large rating agencies exert a monopolistic influence over the ratings market. But their actions, like a rating change on the basis of inadequate methods, can have a domino impact on global fiscal stability. However, there are no real means to hold them accountable.

- "Noisy, opaque and biased":

- The Economic Survey 2020-21 has criticised the sovereign credit ratings methodology for opaqueness and not reflecting the fundamentals.

- Eg: India’s willingness to pay its debts is unquestionably demonstrated through its zero sovereign default history and the USD 630+ billion forex reserves. However, this has not been effectively reflected in India’s rating.

- Conflict of interest:

- The rating agencies follow an "issuer pays" model, in which nations pay the agencies to have its own creditworthiness evaluated. This creates an inherent conflict of interest.

- Pro-cyclicality:

- It is a widespread practice among rating agencies to downgrade credit ratings in periods of crisis. But this may lower aggregate investment into the economy and further worsen the financial stability of the country. India has already raised the issue of pro-cyclicality of credit ratings in G20.

WAY FORWARD:

- Change assessment methodology:

- Sovereign credit ratings methodology must be amended to reflect economies’ ability and willingness to pay their debt obligations by becoming more transparent and less subjective.

- Investor-pays model:

- The potential conflicts of interest that arises from the "issuer pays" model would not occur if investors pay for the ratings.

- Bank for International Settlements:

- Given the criticality and magnitude of the effort, a multilateral agency such as the Bank for International Settlements (BIS) is better placed to take up the job of sovereign-risk assessment.

- International collaboration:

- Developing economies must come together to address the bias and subjectivity in sovereign credit ratings methodology and bring in more transparency to prevent exacerbation of crises in future.

- Prioritize India’s needs:

- The Economic Survey advises that India’s fiscal policy should be guided by considerations of growth and development rather than be restrained by biased and subjective sovereign credit ratings.

PRACTICE QUESTION:

Q. ‘India’s Sovereign Credit Rating does not reflect its fundamentals.’ In this regard, write a critical note on sovereign credit rating?