Social Security for Gig & Platform Workforce

2023 AUG 4

Mains >

Economic Development > Indian Economy and issues > Labour reforms

IN NEWS:

- Recently, the Rajasthan assembly passed a bill extending social security to gig workers in the state, the first of its kind in the country.

MORE ON NEWS:

- The Rajasthan Platform Based Gig Workers (Registration and Welfare) Bill, 2023 seeks to register all gig workers and aggregators in the state, facilitate guarantee of social security to gig workers, and give them an opportunity to air any grievances.

- A vital component of the bill is setting up a welfare board, titled The Rajasthan Platform-Based Gig Workers Welfare Board, which will have two members each from gig workers and aggregators to be nominated by the state government, besides two civil servants.

- The board will ensure the registration of gig workers and aggregators operating in the state and establish a social security and welfare fund for gig workers.

- The bill states that the state government will maintain a database of gig workers and generate a unique ID for every one of them.

- The bill also provides gig workers access to general and specific social security schemes; opportunity to be heard for any grievances and appropriate grievance redressal mechanism; and participate in all decisions taken for their welfare through representation in the board.

GIG AND PLATFORM WORKERS:

- A gig economy is a free market system in which temporary, flexible jobs are commonplace and companies tend toward hiring independent contractors and freelancers instead of full-time employees.

- Workers perform “gigs,” in which they are employed for a specific task or time. This is done to achieve advantage of cost, quality, and flexibility. Once the task is complete, the worker is free to move on.

- Gig workers can be broadly classified into platform and non-platform-based workers.

- Platform workers are those whose work is based on online software apps or digital platforms.

- Non-platform gig workers are generally casual wage workers and own account workers in the conventional sectors, working part-time or full time.

|

NOTE:

The Code on Social Security, 2019 introduces definitions for ‘gig worker’ and ‘platform worker’:

- Gig workers refer to “a person who performs work or participates in a work arrangement and earns from such activities outside of traditional employer- employee relationship”

- Platform workers are “those who access organizations or individuals through an online platform and provide services for payment”.

|

WHY SOCIAL SECURITY BENEFITS NEED TO BE PROVIDED TO GIG AND PLATFORM WORKERS?

- Lack of unionisation and collective bargaining:

- Since platform workers seldom meet or get together, it makes it difficult for them to form associations or unions for collective bargaining.

- Weak collectivization constrains the ability of workers to negotiate with platforms or employers for social security benefits, to settle disputes and redress grievances.

- Do not benefit from labour regulations:

- Platform workers in India are classified as “independent contractors,” or as “driver/delivery partners.”

- As a result, workers do not benefit from labour regulations pertaining to wages, hours, working conditions, and the right to collective bargaining.

- For instance, companies like Uber demands obligations from its drivers as any full-time employer, but without any perks or protections. Uber insists that its drivers are independent contractors and not employees.

- Outside the traditional employer-employee arrangement:

- There is a lack of adequate social security for these workers as they are considered outside the traditional employer-employee arrangement.

- For instance, while traditional employment often includes access to an employer-sponsored retirement fund, gig workers are on their own. A report stated that only 28% of gig workers participate in a retirement savings scheme, emphasising the importance of retirement planning awareness in this segment.

- Similarly, health insurance is another critical concern. Traditional employees often enjoy the advantage of employer-sponsored health coverage. In contrast, gig workers must source their insurance independently.

- Unstable income:

- Traditional employment provides a predictable income flow, but gig work can lead to uncertain income periods based on project availability.

- As workers are paid based on the completion of tasks or projects, the total amount a worker earns at the end of the week or month remains uncertain.

- Lower credit access to workers:

- Financial institution resist extending credit when steady income is not assured

- Demand-supply mismatch may results in fluctuating wages in labour market.

- Exploitation:

- Gig workers are exploited by giant tech companies with poor wages, punishing hours, and lack of labour rights.

- Inequality among gig economy workers:

- People with higher skill set (video producers, software engineers etc.) have higher bargaining power and hence earns fair remuneration, while people at lower strata (delivery boys, chauffeurs etc) have neither financial security nor dignity of labour.

- Financial dependencies of workers on the gig economy

- Workers require existing assets like vehicular assets for entry into the platform economy, thus they have to rely on intensive loan schemes provided by workers rely on intensive loan schemes.

- It creates a dependency of workers on Platform Company.

- It removes the flexibility benefit provided by the economy to its workers and make him liable to work under their terms and conditions.

- Difficult for the Government to regulate:

- Difficult to regulate due to flexible and dynamic nature of gig and platform workforce.

- Hence execution of tax laws and labour laws becomes largely ineffective.

- Issues in Labour laws coverage for gig workers:

- Employees by law are guaranteed minimum wages, regulated hours of work, healthcare and other benefits.

- Independent contractors, however, do not have a valid claim to these benefits, since they merely use the platform provided and do not work directly for the corporations.

- This distinction has played a critical role in the emergence of the gig economy as it allows tech corporations to avoid labour regulation altogether.

- Companies such as Uber have successfully avoided their contributions to employee benefits by reconfiguring the relationship and classifying workers as independent contractors

- Due to the absence of clear provisions in the labour codes, gig workers can claim benefits, but not labour rights.

- Though gig workers are covered under social security schemes none of these benefits are secure, which means, the Central government, from time to time, can formulate welfare schemes that cover these aspects of personal and work security, but they are not guaranteed.

GOVERNMENT INITAIVES:

- Code on Social Security:

- The code has provisions to ensure labour benefits for gig-economy workers.

- The code provides that central or state government may notify specific schemes for gig workers to provide various benefits, such as life and disability cover. Such schemes may be financed through a combination of contributions from the employer, employee, and the appropriate government.

- The code also provided for the establishment of a national and various state-level boards for administering schemes for unorganised workers, gig workers and platform workers.

- e-SHRAM portal:

- The Ministry of Labour and Employment launched the e-Shram Portal for creating a National Database of Unorganized Workers.

- It is the first-ever national database of unorganised workers including migrant workers, construction workers, gig and platform workers, etc.

- National Social Security Board:

- It aims to recommend to the Central Government for framing suitable schemes for unorganised workers, gig workers and platform workers and to such monitor social welfare schemes.

WAY FORWARD:

- Government schemes:

- With a few tweaks, some social security provisions for informal workers can be extended to gig workers.

- For instance, the PM-Jan Arogya Yojana automatically excludes people owning two, three, or four-wheelers. There is no consideration given to the fact that owning a vehicle is a work-necessary measure for gig workers. The PM Shram Yogi Maan-dhan scheme too can be extended to gig workers if the income ceiling of ?15,000/month is increased.

- Introduce tripartite system:

- Introduce tripartite system which includes labour unions, managements and the government to resolve disputes in gig economy.

|

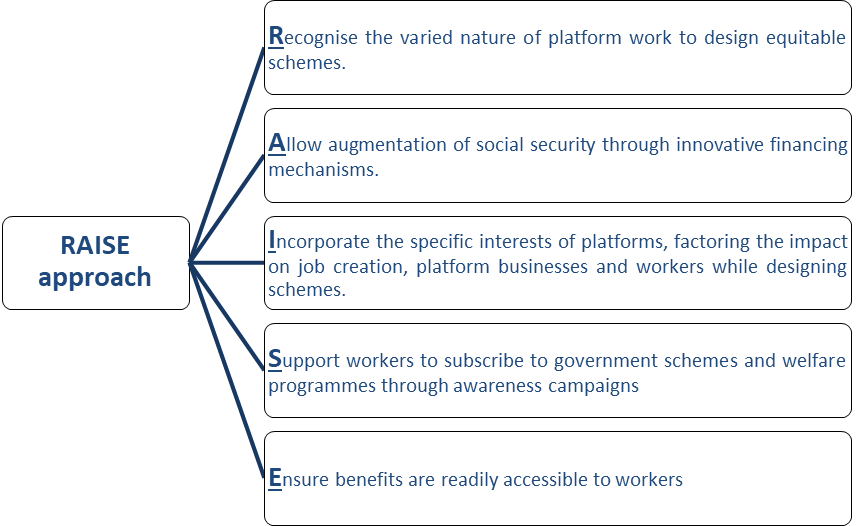

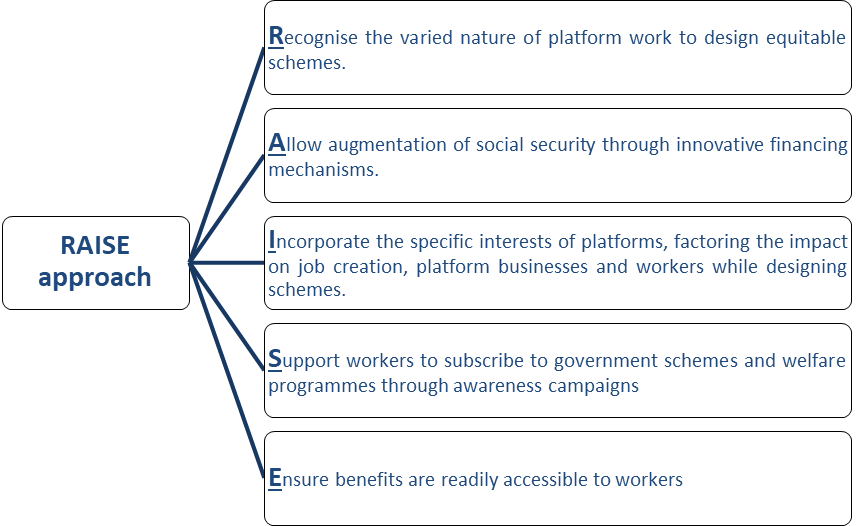

RECOMMENDATIONS MADE BY NITI AAYOG IN ITS REPORT TITLED ‘INDIA’S BOOMING GIG AND PLATFORM ECONOMY’:

- NITI Aayog has recommended extending social security measures to gig workers and their families, including paid sick leaves, insurance and pension plans.

- In its report, NITI Aayog suggested gig firms adopt policies that offer old age or retirement plans and benefits and other insurance cover for contingencies such as injury arising from work that may lead to loss of employment and income. The report further said that such plans and policies may be uniquely designed by a firm in partnership with insurance companies or could be designed and offered in collaboration with the government, as envisaged under the Code on Social Security, 2020.

- The report has also suggested the creation of a corpus fund to support gig and platform workers and other self-employed individuals associated with the gig and platform sector in case of contingencies.

- It also suggested support for gig workers in "situations of irregularity of work". Citing New York City as an example, the report said that during the first COVID wave in 2020, the drivers who were licenced with the Taxi & Limousine Commission were given delivery work that came with a minimum wage guarantee. On similar lines, such an initiative may be incorporated by gig and platform firms to provide income support to workers.

|

|

BEST PRACTICE:

California's gig worker law

- The state of California in U.S recently has legislated that workers in the gig economy be classified as workers and not as independent contractors >> thus guaranteeing minimum wage and welfare benefits

|

PRACTICE QUESTION:

Q. “Gig or platform workers lack basic labour rights and social security in most of the economies including India”. Discuss.