Strategic Petroleum Reserves

2021 NOV 24

Mains >

Industry and infrastructure > Infrastructure & Investment models > India & West Asia

IN NEWS:

- India has agreed to release 5 million barrels of crude oil from its strategic oil reserves in coordination with other major consumers, including the US, China, Japan and South Korea to cool international oil prices.

STRATEGIC PETROLEUM RESERVES (SPR):

- SPR are crude oil inventories (or stockpiles), usually held by a country, to safeguard the economy and national security during an energy crisis.

- The concept was first mooted in 1973 in the US, after the 1973 oil crisis. Later crises, like the 1979 oil crisis and Iraqi invasion of Kuwait, gave further impetus to the idea.

- All major countries hold oil in emergency reserves. For eg: America has created SPRs in underground salt caverns in Texas and Louisiana. They hold about 605 million barrels of oil.

|

MAJOR OIL CRISES:

|

- The 1973 oil crisis:

- Also called the "first oil shock", it began when the Organization of Arab Petroleum Exporting Countries proclaimed an oil embargo, targeted at nations perceived as supporting Israel during the Yom Kippur War.

- The targeted nations were the United States, Canada, Japan, the Netherlands, the United Kingdom and South Africa.

|

- The 1979 Oil Crisis:

- Also known as the Second Oil Shock, was an energy crisis caused by a drop in oil production in the wake of the Iranian Revolution.

|

- First Gulf War:

- In August 1990, Iraq invaded Kuwait, sending the price of oil soaring from about $34 per barrel to nearly $77.

- After a U.S.-led military coalition succeeded in removing Saddam Hussein's Iraqi forces from Kuwait in early 1991, the price fell to about $37.

|

- The 2008 Oil Shock:

- A series of events that cut global production sharply led to a significant spike in oil prices. Eg: Venezuela cut off sales to Exxon Mobil in a legal battle over nationalization of that company's properties, labor strikes reduced production in Nigeria and the U.K.'s North Sea oil fields and Mexico endured a severe decline in production from one of its major oil fields. As a result, the price of oil rose to above $165 by mid-2008.

|

- U.S. Shale Oil Revolution:

- U.S. oil and gas output increased by about 57% over the past decade until early 2020 as advances in fracking technology. Partly as a result, the price of crude oil fell from about $87 per barrel in early 2010 to just under $51 by January 2020.

|

INDIA AND SPRs:

- India started development on a strategic crude oil reserve in 2003.

- Today, the Government has set up 5.33 million metric tons (MMT) of strategic crude oil storages, enough to provide 9.5 days of consumption.

- They are at three locations namely, Visakhapatnam, Mangalore and Padur (near Udupi).

- Under Phase II, Government has given approval for establishing two additional commercial-cum-strategic underground storages at Chandikhol (4 MMT) and Padur (2.5 MMT) on PPP mode. This will add 11.57 days more.

- The storages are constructed in underground rock caverns.

- Crude oil to these caverns is supplied by oil exporting giants through long term agreements. Eg: Half of Mangalore’s storage has been hired by Abu Dhabi National Oil Co (ADNOC) to store its crude oil.

- Crude oil from these caverns can be supplied to the Indian Refineries either through pipelines or through a combination of pipelines and coastal movement.

- Indian Strategic Petroleum Reserves Limited (ISPRL), a Special Purpose Vehicle and a wholly owned subsidiary of Oil Industry Development Board (OIDB) under the Ministry of Petroleum & Natural Gas undertakes the construction of the Strategic Crude Oil Storage facilities.

- Engineers India Limited (EIL) worked as the Project Management Consultant for the three locations.

NEED OF SPRs:

- Import dependency:

- India is dependent on imports to meet 85% of oil demand and 55% of natural gas requirements. Such an import dependency increases the vulnerability to threats of physical supply disruptions.

- Manage oil shocks:

- The oil market is susceptible to an array of global events, like tensions in middle east, stock market fluctuations, OPEC policies and USA’s sanctions. All of this can increase the oil prices drastically, which can severely affect India’s exchequer.

- Influence OPEC+:

- Major oil consumers, including India, have been unsuccessfully trying to persuade the Opec-plus grouping to reduce oil prices to aid the global economic recovery. By releasing oil from reserves in a coordinated manner, the idea is to put more oil on the market and thus force a price fall.

- Rising demand:

- Despite the thrust on renewables and natural gas, petroleum continues to be the primary fuel for India. The World Energy Outlook 2019 published by International Energy Agency shows that India’s oil demand in total primary energy is projected to increase from 233 MT in 2018 to 305 MT in 2025.

- Asian premium:

- Asian Premium is extra charge being collected by OPEC countries from Asian countries when selling oil in comparison to western countries. India has been voicing its dissent against this practice.

- Having a reserve stock will help India counter any threats to supply from the OPEC and continue its efforts to curb the discriminatory pricing system.

- Full membership in IEA:

- Recently, the IEA has invited India to become its full-time member. One of the eligibility criteria to become a full-time member is to have a crude oil reserve equivalent to 90 days of the previous year’s net imports. Hence, to secure the membership, India needs a strong oil reserve.

- Reassure its growth trajectory:

- All major powers have a strong strategic reserve to secure their needs. China has around 80 days of oil in storage, while Japan has a capacity of above 150 days. International Energy Agency (IEA) members maintain emergency oil reserves equivalent to at least 90 days of net imports.

|

ORGANIZATION OF THE PETROLEUM EXPORTING COUNTRIES (OPEC):

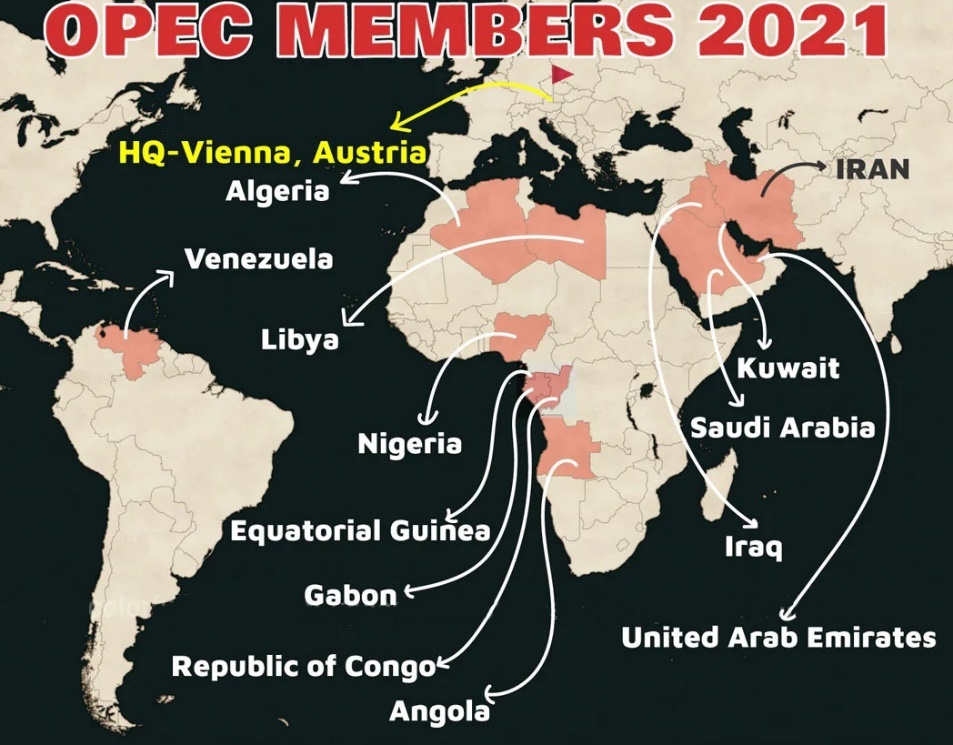

- The OPEC is a permanent intergovernmental organization of 13 oil-exporting developing nations. It is headquartered at Vienna, Austria.

- OPEC produce about 40 % of the world's crude oil and OPEC's exports represent about 60 percent of the total petroleum traded internationally. Because of this market share, OPEC's actions influence international oil prices.

- OPEC seeks to ensure the stabilisation of oil prices in the international oil markets. For this, it coordinates and unify the petroleum policies of its Member Countries.

- OPEC is an example of a cartel that cooperates to reduce market competition.

OPEC PLUS:

- OPEC+ is a loosely affiliated entity consisting of the 13 OPEC members and 10 of the world’s major non-OPEC oil-exporting nations.

|

BENEFITS OF SPRs:

- Energy security:

- The reserves provide a 22-day supply and the Indian refiners maintain 65 days of crude storage. Thus, India has an overall reserve oil storage of 87 days, which would serve as a cushion during any supply disruptions.

- Monetary benefit:

- By stocking up oil at times of price drop and relying on these reserves at times of price hike, India can save forex. This strategy was adopted when there was fall in the international crude oil prices due to COVID crisis.

- Investment avenue:

- PPP model is used for development of phase-2 SPRs, thereby attracting private investment. The Government has also developed plans for commercialisation of the reserves.

- Eg: India leased one of the two chambers at the Mangalore SPR to Abu Dhabi National Oil Co (ADNOC), which they use to re-export oil, mirroring a model adopted by South Korea and Japan.

- Strategic cooperation:

- Oil stockpiling and development opens avenues for strategic collaborations with other nations.

- For eg: India and the US have signed an MoU on operation and maintenance of strategic petroleum reserves and prospect the possibility of India storing oil in the US.

- Safety:

- Underground rock caverns are considered as the safest means of storing hydrocarbons. Unlike large storage tanks, the caverns can be easily protected from threats like fires and sabotages.

CONCLUSION:

- Considering the volatility of the oil prices, a reviving economy and the increasing geopolitical challenges in the Indian Ocean region, it is of critical national importance that India completes the Phase 2 of SPRs with as little pilferage of time and resources as possible.

PRACTICE QUESTION:

Q. Discuss the significance of Strategic petroleum reserves in India’s energy security?