Taxing farmers' income

2023 JAN 30

Mains >

Economic Development > Indian Economy and issues > Agri productivity

IN NEWS:

- In a recently published news article, Bibek Debroy, chairman of the Economic Advisory Council to the Prime Minister, has argued for taxing farmers’ income.

HISTORY:

- During the colonial period, land revenue was a potent source of income for the British. To collect it, the administration created an elaborate administrative machinery and appointed collectors.

- Dr. B.R. Ambedkar criticised the land revenue system of the British but held the view that income from agriculture must attract tax.

- Even after independence, several states retained their Agricultural Income Tax Acts. Such statutes were present in Bihar (1938), Assam (1939), Bengal (1944), Orissa (1948), Uttar Pradesh (1948) and Hyderabad (1950).

- Today, many state governments do levy tax on organized agricultural enterprises, such as plantations, and most collect land revenue.

- Post-Independence, several committees have recommended taxation of agricultural income.

- This includes Report of the Taxation Enquiry Commission (1953–54), Raj Committee on Taxation of Agricultural Wealth and Income (1972), Fourth Five-Year Plan (1969–74), Report of Fifth Finance Commission (1969), Tax Reforms Committee (1991), Kelkar Task Force on Direct Taxes (2002), White Paper on Black Money (2012) and Tax Administration Reform Commission (2014).

CONSTITUTIONAL PROVISIONS:

- Seventh schedule:

- Entry 82 in the Union List mentions taxes other than agricultural income, while entry 46 in the State List mentions taxes on agricultural income.

- So, whether agricultural income should be taxed or not is for state governments to decide.

- Income Tax Act, 1961:

- Section 10(1) of the Income Tax Act stipulates that no income tax will be imposed on agricultural income. In effect, all Indian farmers are automatically exempt from income tax.

SHOULD AGRICULTURE BE TAXED?

YES:

- Improve tax collection:

- Agriculture and allied sector contributed to 20 per cent of GDP in 2020-21, while employing about 45 per cent of the population. Taxing the sector can increase the tax base and generate more revenue for the government.

- Equitable distribution of tax burden:

- The tax-to-GDP ratio of India is about 11%. This is below the average for major emerging markets like Brazil (31%) and South Africa (24%). Taxing agriculture can help increase the direct tax collection, reduce the tax burden on poor and create a more equitable tax base.

- (In a direct tax dominated tax system, there is equity in the sense that the tax contribution comes from those who have the ability to pay.)

- Prevent evasion and money laundering:

- Since income from agriculture is exempt from income tax provision, it is widely misused to evade taxation and launder non-agricultural income. Eg: Income from ‘farmhouse’ is exempt, which is being utilised by many rich Indians for securing tax exemptions.

- Given the size of India’s GDP (about $3.5 trillion in 2021-22), even a 5% rate of legal evasion means a loss of USD 175 billion.

- Affects only the well-off:

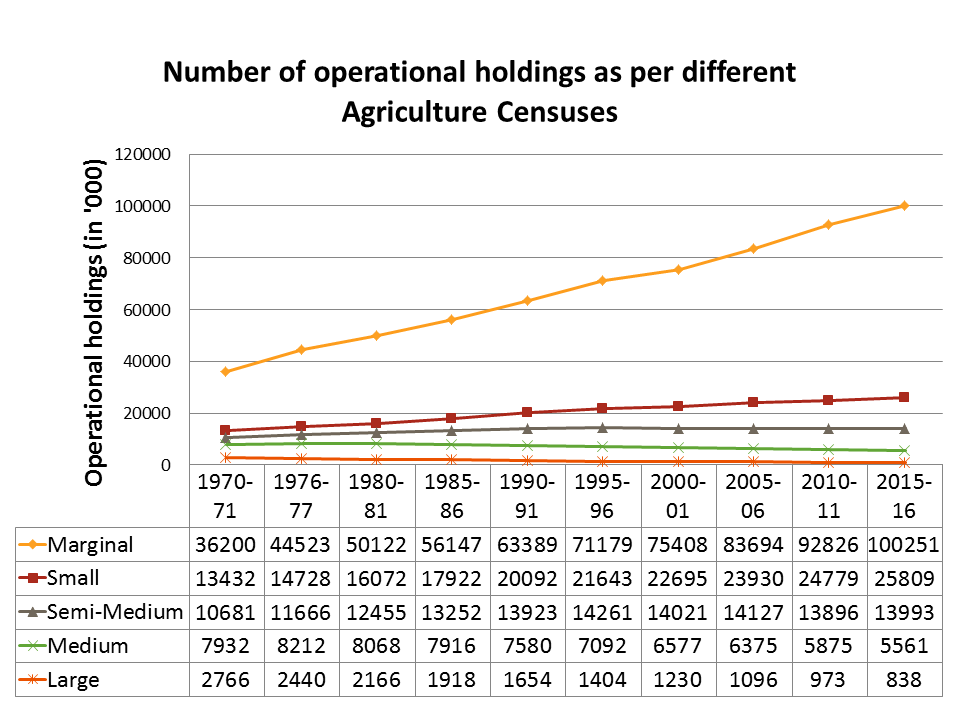

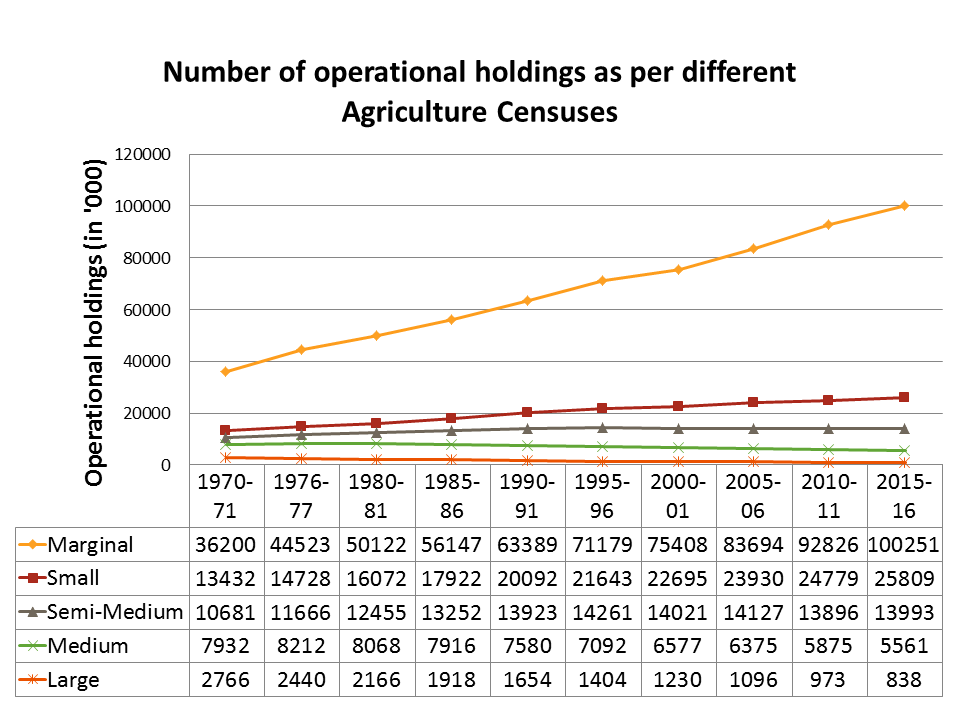

- According to the Agricultural Census 2015-16, those who own more than 4 hectares form just 4% of the total agricultural households but hold over 20% of agricultural income. Since income taxes is applicable only on income above a threshold, only the rich farmers would be taxed.

- Supported by committees:

- Over the years, several committees have recommended the taxation of agricultural income.

- Already in existence:

- Many state governments already levy tax on organized agricultural enterprises, such as plantations.

NO:

- Moral hurdle:

- The performance of agriculture sector has not been encouraging, as is evident from its declining contribution to nation’s GDP over the decades. Despite this trend, Indian farmers continue to feed 1.4 billion Indians. Hence, imposing tax on agriculture raises a moral challenge.

- Weak state of agriculture:

- Informal nature, rising input cost, unstable markets, erratic monsoon and climate change is making agriculture unremunerative, resulting in distress migration and suicides. An agricultural tax would add to the stress faced by the farmer.

- Uncertainties in agriculture:

- Indian agriculture is vulnerable to various factors like monsoon, MSP regime, buffer stock levels and government policies on imports. This, coupled with the rainfed and subsistence nature of farming, makes agricultural income volatile.

- Difficulty in estimation:

- The size of land does not necessarily correspond with farm income. Many farmers lack title deeds (patta) and there is lack of credibility about the way states issue “farmer” certificates. Hence, it would be a challenge to identify the agri income tax payers.

- Low revenue potential:

- The Kelkar task force report of 2002 estimated that 95% of the farmers were below the tax threshold. The Economic Survey 2021-22 said that the average monthly income per agricultural household in the country stood at Rs 10,218 in 2019.

- Hence, only a nominal number of farmers would be covered if an income tax on agriculture is imposed.

- Political challenge:

- Following the success of green revolution, agrarian unions have emerged as a major vote bank and pressure group in the Indian political arena. In this situation, initiating agrarian reforms, like the three farm acts, have proved to be major challenge.

- Weak enforcement mechanisms:

- Existing mechanisms for tax collection has been found lacking while verifying the claims of tax exemptions, leading to tax evasion.

- For instance, the CAG had found that the income tax department allowed exemptions without verification of supporting documents such as land records, income and expenditure statements, crop information and proof of agricultural income and expenditure.

WAY FORWARD:

- Initiate agrarian reforms:

- Before introducing tax, government should work towards increasing the productivity, profitability and sustainability of agriculture. To attain this, accessibility and affordability to high yielding seeds and plant breeds, formal credit, critical infrastructures like irrigation, pre and post-harvest treatment, storage and transport infrastructure needs to be ensured.

- Enhance competitiveness:

- Markets reforms must be undertaken to enhance the quality and cost competitiveness of farm commodities to make them globally competitive. In this regard, the three farm laws must be revisited.

- Make agriculture attractive:

- Agriculture needs to be made an attractive sector for India’s youth. This would require the formalisation of agriculture, creating adequate entrepreneurship opportunities and initiating more agri-related professional courses across the country to create a band of agro-professionals.

- Plug loopholes:

- Besides bringing agricultural income under income tax, government could do well to plug evasion and avoidance on several counts. These include plugging GST evasion, simplifying tax compliance, curbing tax abuse by multinationals and strengthening the enforcement institutions.

- Alternatives to agricultural tax:

- To take into account the agricultural income beyond a certain threshold, non-tax alternatives can be utilised. For instance, differential subsidies (Eg: Subsidy on fertiliser cannot be availed if agricultural income is beyond a threshold) can be implemented.

PRACTICE QUESTION:

Q. There is a point of view that income from agriculture in India needs to be taxed. Critically examine.