Telecom Sector In India

2022 MAY 26

Mains >

Economic Development > Indian Economy and issues > infrastructure

WHY IN NEWS?

- The Indian telecom sector has seen significant reform in recent times to improve sectoral health and increase ease of doing business.

- To attract investment, foreign investors can now invest up to 100% in any local Indian company without government approval.

- Licensing conditions have also recently been amended to enable use of private satellite systems (including foreign satellite systems), further encouraging the entry of foreign investors.

BACKGROUND:

- Statistics:

- India is currently the world’s second-largest telecommunications market with a subscriber base of 1.20 billion and has registered strong growth in the past decade and a half.

- According to Groupe Speciale Mobile Association (GSMA) report, as of January 2019, India has witnessed a 165% growth in app downloads in the past two years. (India surpassed the US in app downloads)

- As per a report by Ericsson, India has the world’s highest data usage per smartphone at an average of 9.8 GB per month.

- Tremendous growth:

- Tele-density of Indian telecom industry (wireless plus wire line) has grown from a low of 3.60% in March 2001 to 84% in March 2016.

- As of July 2019, India achieved 100% digitisation of cable TV network.

- Over 75% increase in internet coverage from 251 million users to 446 million. The number of internet subscribers in the country is expected to double by 2021 to 829 million

- Relevance:

- Telecom is the second highest revenue earner for the government, after income tax

- The sector is expected to contribute as much as 90% of the government’s non-tax revenue.

- Digital India programme is also almost completely dependent on the telecom sector.

- Evolution of the sector in India:

- Telecommunications was first introduced in India in 1851 when the first operational land lines were laid by the government near Kolkata

- In 1947, after India attained independence, all foreign telecommunication companies were nationalised to form the Posts, Telephone and Telegraph (PTT)

- The Indian telecom sector was entirely under government ownership until 1984, when the private sector was allowed in telecommunication equipment manufacturing only.

- Evolution of the industry started after the Government separated the Department of Post and Telegraph in 1985 by setting up the Department of Posts and the Department of Telecommunications (DoT).

CHALLENGES:

- FOR TELECOM COMPANIES:

- Predatory pricing and stiff competition:

- With the entry of Reliance Jio with lot of freebies, other telecom players are also compelled to adopt such pricing practices which in turn affects the profitability and financial viability of the industry in the long term

- Currently, telecom tariffs are among the lowest globally, driven down due to intense competition

- The data price in the country came down by over 99% during 2016-2019

- Delays in the roll out of innovative products and services:

- Substantial delays in roll out of data based products and services due to government policies and regulations, are hampering the progress of telecom sectors.

- License fee:

- The license fee of eight per cent of the Adjusted Gross Revenue including five per cent as Universal Service Levy (USL) is one of the highest in the world.

- Financial stress in the industry:

- Substantial competition and low tariff rates by telecom operators since 2016 have led to a financial stress in the sector.

- The telecom industry is reeling under a debt of over ?4 lakh crore and has been seeking a relief package from the government

- High Right-of-Way (ROW) cost:

- Sometimes, state governments charge a huge amount for permitting the laying of fiber, etc.

- Lack of fixed line penetration:

- India has very little penetration of fixed-line in its network whereas most of the developed countries have a very high penetration of fixed lines (telephone line that traveled through a metal wire or optical fiber as part of a nationwide telephone network).

- Only around 25% of Towers in India are connected with fibre networks, whereas in developed nations, it is in excess of 70%.

- 5G Network requires towers to be connected to with very high-speed systems. Those high speeds are not possible on the present radio systems.

- Declining Average Revenue Per User (ARPU):

- ARPU decline now is sharp and steady, which, combined with falling profits and in some cases serious losses, is prompting the Indian telecom industry to look at consolidation as the only way to boost revenues.

- Recently, the Supreme Court allowed the government’s plea to recover adjusted gross revenue of about Rs 92,000 crore from telecom companies >> further adds to their stress.

- Over the Top (OTT) applications such as WhatsApp, OLA and so on do not need permission or a pact with a telecommunications company. This hampers the revenue of telecommunication service providers.

- Limited spectrum availability:

- Available spectrum is less than 40% as compared to European nations and 50% as compared to China.

- FOR PUBLIC:

- Lack of telecom infrastructure in semi-urban and rural areas:

- Service providers have to incur huge initial fixed cost to enter semi-rural and rural areas.

- Low broadband penetration:

- Low broadband penetration in the country is a matter of concern. As per white paper presented on broadband at the last International Telecommunication Union (ITU), broadband penetration in India is only 7%.

- Digital divide:

- Rural-Urban divide:

- India had just 14.9 per cent rural households having access to the internet against 42 per cent households in urban areas.

- Gender gap:

- Only 21 per cent of women in India are mobile internet users, according to GSMA’s 2020 mobile gender gap report

GOVT INITIATIVES:

- Bharat Net:

- To provide high speed digital connectivity to rural India at affordable price and to facilitate proliferation of broadband services in rural areas so as to foster socio-economic development

- National Broadband Mission:

- Objectives are the mission are:

- To ensure that all villages to have access to broadband by 2022

- Accelerate fiberization of telecom towers

- To enhance connectivity and improve Quality of Service by increasing tower density

- Facilitate rollout of 5G network and strengthening of 4G network

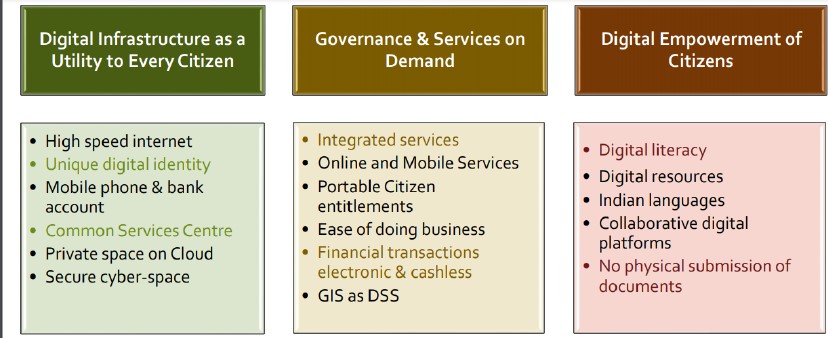

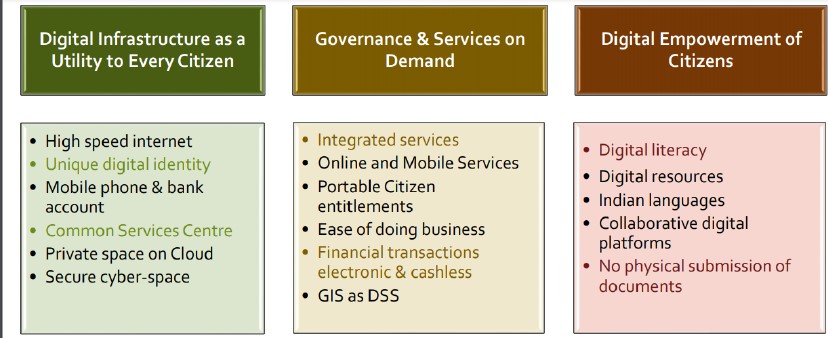

- Digital India Programme:

???????

???????

- Relaxation of FDI norms:

- 100% FDI is allowed in telecom sector, of this 49% is allowed through the automatic route

- Telecommunication Interconnection(2nd amendment )Regulation,2020

- Paving the way for easier interconnectivity between any two fixed line networks and between fixed line and national long distance (NLD) networks.

- A new National Digital Communications Policy – 2018

- NDCP 2018) was unveiled in to replace National Telecom Policy-2012, to cater to the modern needs of the digital communications sector of India.

- The policy aims to attract USD 100 billion worth of investments and generate 4 million jobs in the sector by 2022.

- Digital Communications Commission:

- Telecom Commission was re-designated as the Digital Communications Commission

- DCC Implements Government's policy in all matters concerning telecommunication.

- National e-Governance Plan:

- Under this the government intends to set up over 1 million internet-enabled common service centres across India

- Make in India:

- In March 2020, the government approved the Production Incentive Scheme (PLI) for Large- scale Electronics Manufacturing.

- The scheme proposes production-linked incentive to boost domestic manufacturing and attract large investments in mobile phone manufacturing and specified electronic components including Assembly, Testing, Marking and Packaging (ATMP) units.

- Skill Development:

- In 2017, Microsoft India signed an MoU with Telecom Sector Skill Council to encourage skill development through ‘Project Sangam’

- Tarang Sanchar:

- Department of Telecommunication launched ‘Tarang Sanchar’ - a web portal sharing information on mobile towers and EMF Emission Compliances.

SUGGESTIONS:

- Robust regulatory regime:

- Curb on predatory pricing:

- Government should fix a minimum price to save the industry from price war

- Reduce reserve price for spectrum auction:

- In the past, some of the operators participated recklessly in these auctions leading to exaggerated prices — much above their true valuations. Reasonable reserve prices for the market mechanisms induce “truthful bidding”

- Strengthening regulatory authorities:

- Telecom Regulatory Authority of India (TRAI) has an important role to play as a watchdog of the sector

- Regulators should minimize entry barriers by reforming licensing, taxation, spectrum allocation norms

- A more proactive and timely Dispute Resolution by TDSAT (Telecom Disputes Settlement and Appellate Tribunal) is the need of the hour.

- Increase government spending on R&D:

- The government should spend large on R&D and create an environment that makes India capable of manufacturing and exporting hardware components like mobile handsets, touch screen monitors etc

- Infrastructure:

- The promotion of indigenous ICT development under Atmanirbhar Abhiyan can play a significant role.

- Make more spectrum available for data usage through enhancement in spectrum limit.

- We should also explore migration to new technologies like 5G. It would resolve some of the bandwidth challenges.

- Expansion:

- Penetration of rural markets (70% of population staying in rural areas) will be the key growth driver.

- Availability of affordable smart phones and lower tariff rates would increase telecom penetration in rural areas.

- Digital literacy:

- Digital literacy needs special attention at the school / college level

- Higher digital literacy will not only bring socio-economic empowerment but also contributes to higher growth in the telecommunication sector with widening consumer base

- Cyber security

- India need to evolve a comprehensive cybersecurity framework for data security, safe digital transactions, and complaint redressal.

- Telecom ombudsman:

- The government should also set up telecom ombudsman for the redress of grievances.

- NDCP-2018 advocates:

- Establishment of a National Digital Grid by creating a National Fibre Authority

- Establishing Common Service Ducts and utility corridors in all new city and highway road projects;

- Creating a collaborative institutional mechanism between Centre, States and Local Bodies for Common Rights of Way, standardization of costs and timelines

PRACTICE QUESTION:

Q. Do you agree with the view that increasing consumer base and investment have improved the economic prospects of telecom sector in India? Give reasons in support of your argument

???????

???????